The world is seeing growing challenges that are affecting the real – and the financial economy, including banking and insurance companies. In the last two years, countries in Europe and Central Asia (ECA) are seeing the gains of ten years of reform and investment for inclusive growth and shared property drastically diminished by the Covid-19 pandemic, adverse climate events, and the war in Ukraine; these events have been disrupting supply chains and led more recently to rapid changes in prices of energy, food, and commodities, leading to inflation and rising interest rates.

The World Bank Centre for Financial Reporting Reform (CFRR) organized the 2022 IFRS Regulators Forum around the topics of sustainability and climate risks in addition to the traditional focus on International Financial Reporting Standards (IFRS).

In the first session, Pascal Frerejacque presented a publication “Informing the reading of IFRS financial statements: a guide for banking and financial supervisors” providing insights for reading and reviewing financial statements of banks. The financial information produced by banks under IFRS is large and complex and readers of the financial statements must focus on key judgments and estimates made by the management of banks when drawing financial statements as well as on current supervisory issues. The guide provides elements for supervisors to draw critical information from financial statements to support their supervisory activities.

In the second session, David Gruenberger, Julia Lemonia Raptis, and Juan Ortiz, participated in a panel discussing“the role of supervisors in supervising climate related risks”. Key takeways are:

Sustainable finance is here to stay and supervisors and regulators around the globe are taking action: environmental, social, and governance (ESG) factors, including climate risks, should be analysed and managed within the traditional risk categories as well as at asset level and microprudential and macroprudential levels, which requires the introduction of a new skillset in supervisory teams.

Data can be a challenge: the uneven granularity and the large variability of information in every industry segment complicates the analysis. Sometimes banks claim that they don’t have the right data. Getting the right ESG data , including climate data might be difficult, however best efforts are needed – better to start somewhere than to wait too long.

The Austrian Financial Market Authority has published a guide for managing sustainability risks in 2020. It is a cross sectoral guide to foster knowledge and prepare for EU legislation on sustainability. To reach its objective of effectively managing sustainability risks, cooperation is key: building a strong network nationally and at European and international level is crucial, including new stakeholders such as environment agencies, climate ministries, and financial market participants.

In a recent assessment, the European Central Bank found that all banks are not equally transparent or diligent when disclosing information on climate related risks they face and how they are organized to mitigate those risks. This disparity does not depend on the size of the banks but on how much they are organized to tackle the issue of climate risk and their perception of the materiality of their risks.

Banks have a good track record at dealing with risks individually; tracking risks concomitantly, including health and climate risks, however, has proven more difficult. The occurrence of mulitifile risks rising at the same time as been a source of crisis in the past.

The World Bank provides assessments and knowledge globally and has launched several knowledge products since 2019. Juan Ortiz presented the work of the Financial Stability Advisory Centre (FinSAC), detailing specific regulatory actions to assess risks from climate change for supervisory institutions in the region and incorporate climate-related risks in the supervisory review and evaluation process (SREP) and other supervisory activities.

The Vienna Initiative – a framework for safeguarding the financial stability of emerging Europe launched in 2009 and in which the World Bank Group participates – has recently set up a working group on climate change and financial stability to discuss relevant issues on data availability, supervision and regulation, and transition strategies.

During the third session, Tadeu Cendon presented the current work program of the International Accounting Standard Board (IASB). The post-implementation review of IFRS 9 has shown some issues raised in four of the nine areas of focus but nothing fundamental. An open discussion took place about the challenges of IFRS implementation in ECA. The IASB encourages stakeholders to make written comments during or outside the post implementation review. All comments are reviewed by the staff of the IFRS Foundation and can be helpful to solve implementation issues. The IASB will continue the post implementation review of IFRS 9 in the coming months.

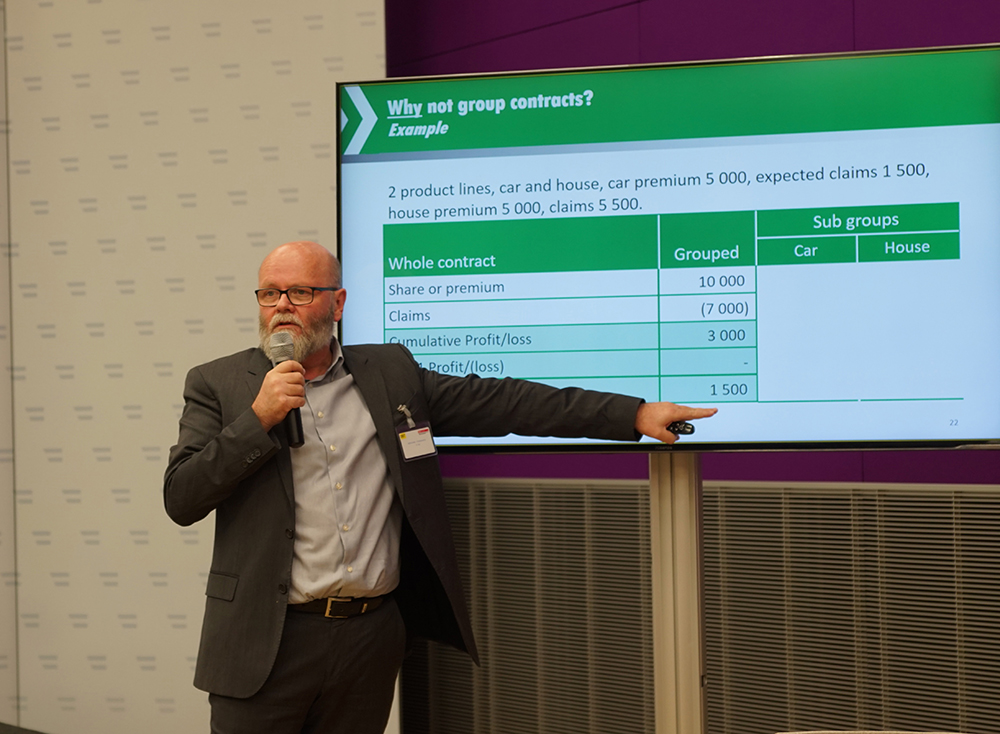

For the final session, Darrel Scott led discussions on the new IFRS 17 – insurance contracts. This standard will be effective in January 2023. As IFRS are not industry specific, this standard will also impact some transactions of banks as some bank products embed insurance products, such as the right to return a product that was bought with a credit card, or a clause suspending mortgage payments in a loan agreement in case of an adverse event.

Participants were very satisfied with the quality of the discussions and the information provided, and confirmed their interest in the topics discussed. They were also confident that the guidance on reading and reviewing IFRS financial statements would be useful to their institutions and that they would share the guide and the knowledge and presentations on climate financial risk with colleagues in their respective supervisory institutions.

David Gruenberger is Head of Section at the European Central Bank where he leads the team for accounting and prudential reporting. Julia Lemonia Raptis is the Head of Division for the Supervision of large regional banks at the Austrian Financial Market Authority; Juan Ortiz is a Senior Financial Sector Specialist at the World Bank FinSac, providing technical assistance in the area of prudential regulation and supervision to supervisory institutions in the European and Central Asia Region. Tadeu Cendon is a Board Member at the International Accounting Standards Board, the standard setter for IFRS; Darrel Scott in a consultant at the World Bank and a former IASB Board member, Pascal Frerejacque is a consultant at the Centre for Financial Reporting Reform and has organized the IFRS Regulators Forum since 2009 and led several publications for this audience.

The IFRS Forum was organized in cooperation with the IFRS Foundation at the Federal Ministry of Finance of Austria. The IFRS Forum is organized under the STAREP and the REPARIS for SME program, that are respectively financed by Austria and the European Union. The Forum included 28 participants representing supervisory institutions from Albania, Armenia, Bosnia and Herzegovina, Croatia. Georgia, Kosovo, Macedonia, Montenegro, Moldova, Serbia and Ukraine and speakers from Austria, France, and South Africa.

Disclaimer: This webpage was created and maintained with the financial support of the European Union. Its contents are the sole responsibility of CFRR and do not necessarily reflect the views of the European Union.