Supervisory staff of the National Bank of the Kyrgyz Republic (NBKR) are better equipped with the knowledge and tools on International Financial Reporting Standards (IFRS) requirements. A four-day training program focused on IFRSs specifically used in banking sector was delivered with KAREP support between February 01 and 08, 2022.

The training included specifically designed case studies, considering local experience and covered the following topics:

- IFRS 9 Financial Instruments: Presentation and Disclosure

- Financial Instruments - Impairment of Financial Assets: overview; General Model & Significant Increase in Credit Risk model (SICR); Measurement of Expected credit losses (ECL); ECL model for purchased or originated credit impaired financial assets; Forward Looking Scenarios

- ECL methodology

- Practical expedients of IFRS 9

- IFRS 9 Impairment: A Common Model Basel Committee Guidance for Banks

- Auditing standard for ECL – ISA 540 Auditing accounting estimates and related disclosures

- Models: Need for models; Model risk management; and Examples of credit risk models

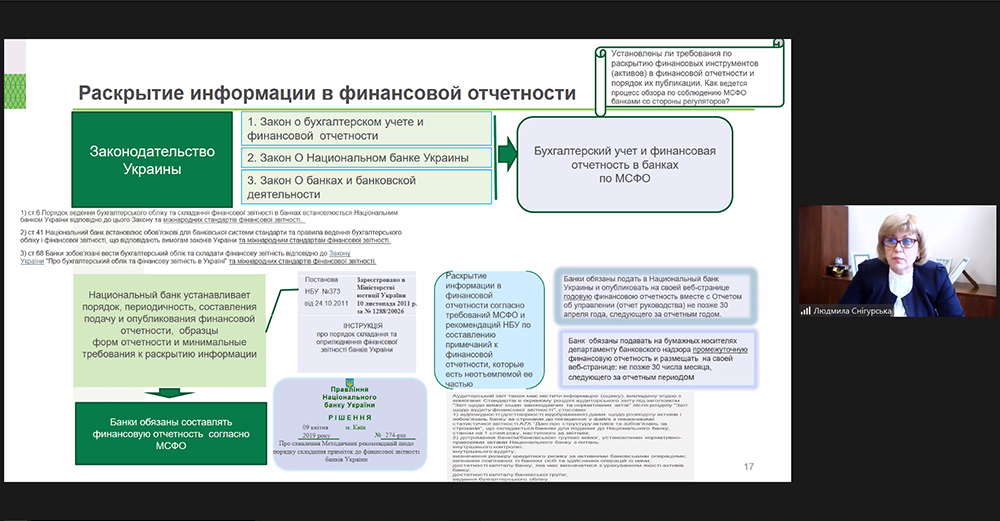

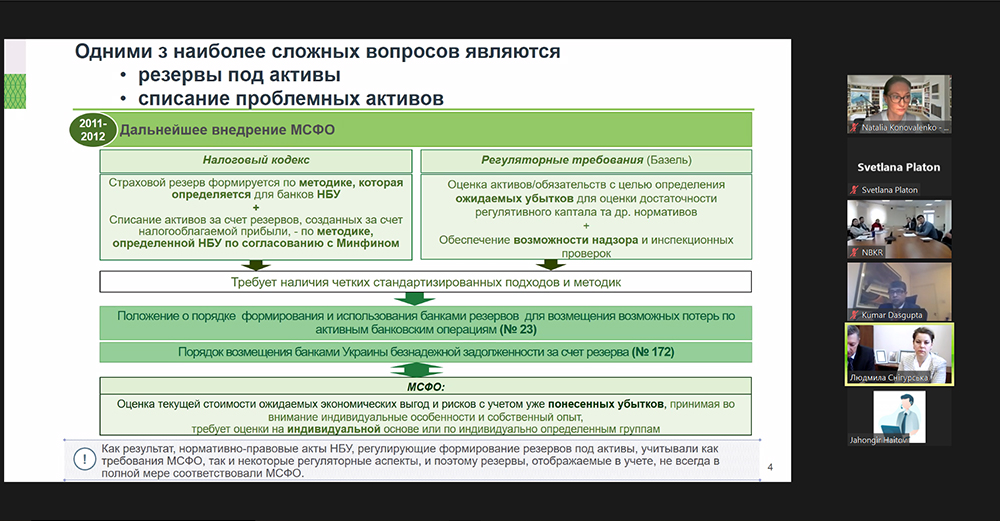

Following the training, on 09 February 2022, an exchange experience webinar was delivered in cooperation with the National Bank of Ukraine (NBU). The Kyrgyz supervisors have studied Ukrainian experience in inspecting banks' reserves under IFRS 9 Financial Instruments and prudential standards.

Representatives of the NBU presented information on the transition of the banking sector in Ukraine to IFRS 9 and shared their professional experience on the organizational aspects of implementation and the challenges they faced when implementing IFRS 9. The presentation was followed by an interactive Questions and Answers session. Direct interaction with experienced staff from the NBU helped the Kyrgyz supervisors to learn in-depth about a proper implementation of the IFRS 9, considering potential challenges that may affect the enforcement, including challenges determined by the current pandemic.