The Financial Stability Board coordinates the work of international regulators to support integrating sustainability policies at the request of the G20, including though climate and environment monitoring, under four key policy areas: firm-level disclosures, data, vulnerabilities analysis, and regulatory and supervisory practices and tools.

Through EU policy, legislation, and strategies the European Union (EU) has set itself the goal of becoming a climate-resilient society by 2050, fully adapted to the unavoidable impacts of climate change. Through the Corporate Sustainability Reporting Directive, the EU requires large companies and all listed companies to disclose information on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment.

The World Bank CFRR has organized the 8th Executive IFRS Workshop for Regulators on November 9-10, 2023. This workshop aimed to update Regulators from partner countries of the efforts from the international community, including by International Sustainability Standard Board, and the International Accounting Standards Board, to address climate change and financial stability risks as well as improving financial reporting for the insurance sector. The Workshop also showcased the Austrian Experience towards greening finance and sustainability reporting.

The workshop brought together 30 participants to learn and discuss about sustainability factors reporting and monitoring, including climate and environment risk monitoring. In addition, the workshop included a session on IFRS 17—Insurance Contracts to discuss together with insurance supervisors about the challenges of its implementation in the Western Balkan region. 23 additional participants attended the session online.

During the workshop, distinguished speakers made the following contributions:

Gunhild Berg, Lead Economist of the World Bank, presented “Greening Financial Sectors in the Western Balkans”, which included the recent results of the fall edition of the Regional Economic Report for the Western Balkans: “Climate physical and transition risks are increasing in severity and frequency due to climate change. These risks cannot only have negative impacts on people and the economy but also pose risks to the financial sector…. As such, it is important for financial institutions and their regulators to understand and be able to manage these risks. At the same time, the financial sector has a role to play in decarbonizing economies and to mobilize much needed climate finance for green investments. The World Bank is assisting countries around the world on climate related financial risks & opportunities.”

Veronika Pountcheva, Board Member of the International Sustainability Standard Board (ISSB), presented the activities of the ISSB: “The main objective of the IFRS Sustainability standards is to provide access to more consistent, comparable, verifiable, and comprehensive disclosures on sustainability factors for better decisions making for investors. Sustainability disclosure is not an easy topic and we are providing many materials to help build capacity of various stakeholders”.

Tadeu Cendon, Board Member of the International Accounting Standard Board (IASB), presented current and future work of the IASB, including work on climate-related and others uncertainties in the financial statements that will complement the work of the ISSB and help investors to connect information included in different parts of general purpose financial statements: “Respondents to the consultations about climate-related and other uncertainties in the financial statements, attributed high priority to an IASB project on climate related risks in the financial statements, and report a concern that current information about those risks is insufficient and inconsistent.”

David Gruenberger, Head of Section at the European Central Bank (ECB), presented a study of the ECB looking how financial institutions are taking into account climate and environmental risks in their financial statements through overlays. “The use of collective staging or the integration of specific risks (e.g., energy intense sector) in the Probability of Default model, or the creation of specific PD/Loss Given Default overlays are preferrable while the use of overlays on total Expected Credit Losses is not a good practice.”

In her presentation on the role of supervisors in alleviating climate change, Julia Lemonia Raptis-Saleh, Head of Division at the Austrian Financial Market Authority, flagged the importance of cooperation to tackle ESG including climate and environment risks: “Cooperation is key – building a strong network nationally, at European and international level is crucial, including new stakeholders such as environment agencies, climate ministries …and on both top-management and technical levels”.

Karl Dobner, Ministry for Climate Action in Austria presented the Green Finance Agenda in Austria: “The Austrian Ministry of Finance and the Ministry for Climate Action introduce 25 measures to mobilize capital, manage risk, and foster transparency, focusing on calendar for implementation including actions and responsibilities.”

Karin Lehnard, Responsible for ESG Strategy at Erste Group discussed the policies and tools in place towards sustainability: “the strategy of Erste Group is to lead the green transition by transitioning to a net-zero portfolio, build leadership in green finance, and transition to net -zero operations; and to promote social inclusion.”

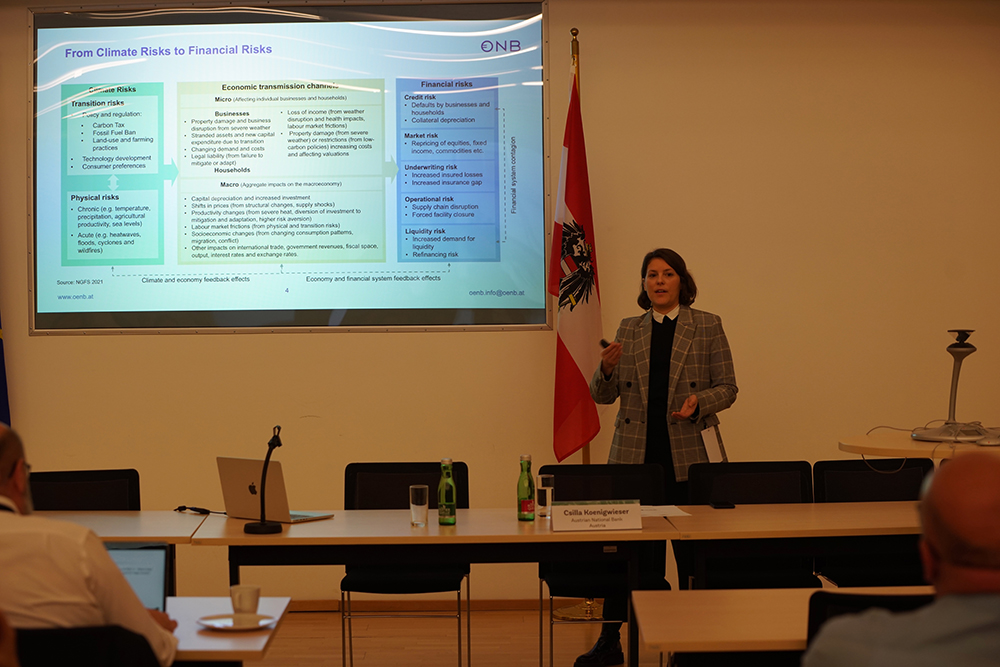

Csilla Koenigwieser, Supervision Policy, Regulation and Strategy Division of National Bank of Austria, presented the Climate Risk Stress Testing from a Supervisory Perspective: “Out of the 2021 stress test performed by the National Bank, Austrian banks’ risk to climate came as manageable. It is important to stress that climate risks come with a very high degree of uncertainty, because of the diversity of scenarios used by banks and the challenges linked to the lack of data and its granularity. The National Bank may conduct a second climate stress test in 2024 or 2025, which will be based on data of higher quality.”

The afternoon of the second day discussed the challenges in application of IFRS 17 – Insurance contracts that will be applicable in 2024 in many countries, and which has been postponed in the Western Balkans.

Kosta Spaseski, adviser, North Macedonia Insurance Supervisor, ANO, presented the state of play of the insurance market in the Western Balkans, based on several responses to a questionnaire collecting information from Albania, Bosnia Herzegovina, and North Macedonia, and public resources.

Darrel Scott, World Bank Consultant, World Bank, discussed the key challenges for implementation of IFRS 17.

Pascal Frerejacque, Consultant World Bank, recapped some of the challenges and a proposal to assist further the countries of the Western Balkans in enhancing their knowledge of IFRS 17 with online seminars and roundtable to take place in 2023-2024.