A five-day workshop convened North Macedonian insurance sector stakeholders in support of ongoing efforts to modernize insurance accounting and embrace sustainability reporting. Attended by 55 participants, the five-day event organized by the World Bank Centre for Financial and Sustainability Reporting Reform (CFRR) focused on International Financial Reporting Standard (IFRS) 17: Insurance Contracts. It was designed to equip industry professionals with a comprehensive understanding of the standard’s requirements, in anticipation of the mandated first implementation in 2028.

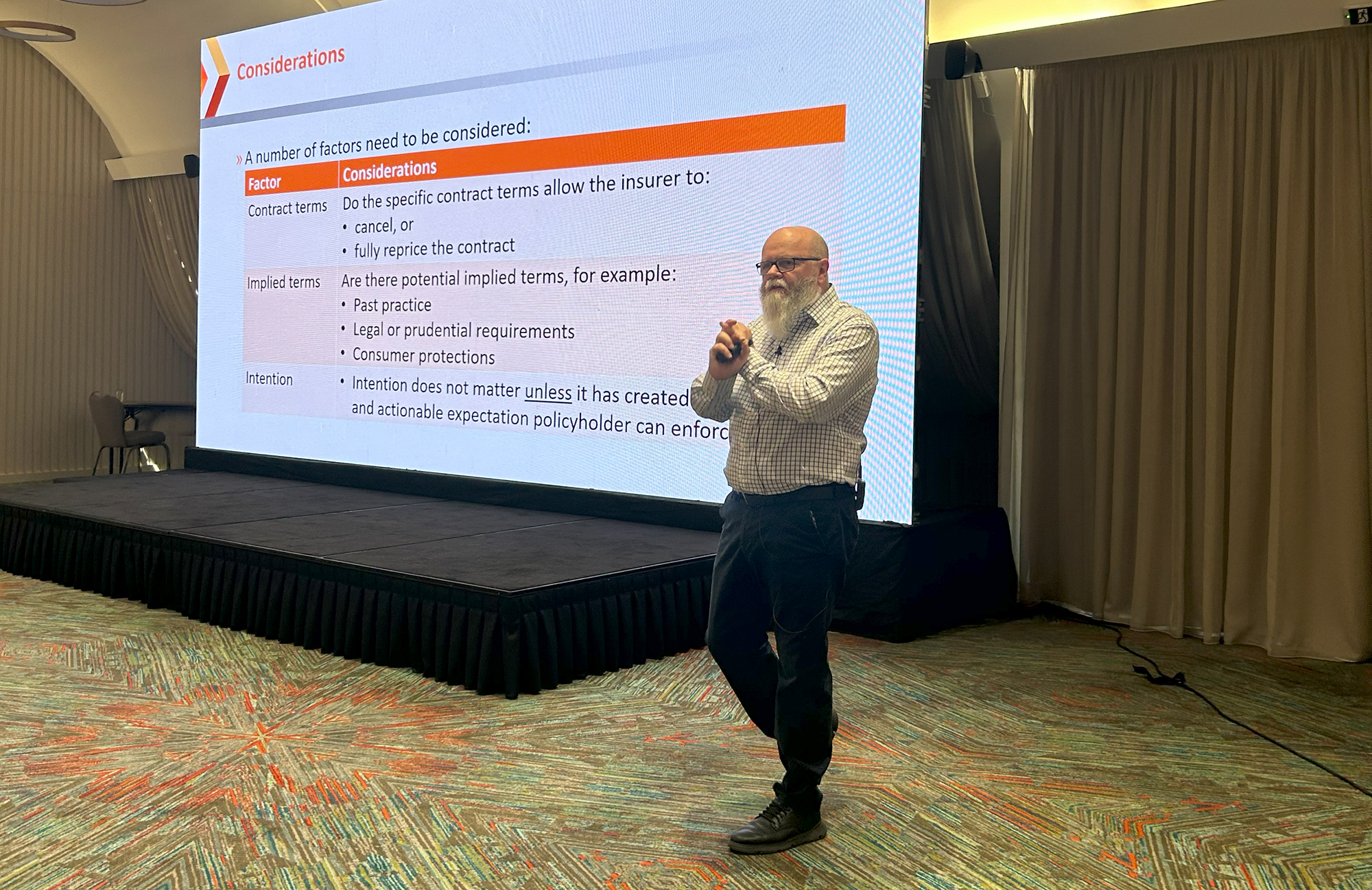

IFRS 17 marks a significant shift in insurance accounting by introducing a standardized framework for measuring, recognizing, and disclosing insurance contracts that aims to improve transparency and comparability. While implementation can be complex and costly, it promises to provide more accurate and insightful financial reporting, enhance risk management, drive operational efficiencies, and offer global comparability for stakeholders. The workshop’s agenda addressed the adoption process and challenges of IFRS 17 for the insurance sector, with a particular focus on life insurance and participation-type contracts. Core topics included the full scope of IFRS 17, covering various measurement models—such as the General Measurement Model, the Premium Allocation Approach, and the Variable Fee Approach—alongside recognition and derecognition, presentation and disclosure, and the transition provisions. In addition, sessions were dedicated to IFRS 9: Financial Instruments and IFRS 18: Presentation and Disclosure in Financial Statements, offering valuable context on the interaction between insurance contracts and financial instruments within financial statements. Specialized knowledge-sharing on the Variable Fee Approach and the emerging IFRS Sustainability Disclosure Standards further enriched the agenda.

The event was part of the CFRR’s Enhancing Accounting, Auditing, and Sustainability Reporting (EAASURE) Regional Program. With a development objective centered on improving corporate financial reporting and advancing the rollout of sustainability reporting across Europe and Central Asia, the program lends critical support to sector reforms in countries including Armenia, Azerbaijan, Albania, Bosnia and Herzegovina, Georgia, Kosovo, Moldova, Montenegro, North Macedonia, Serbia, and Ukraine. The program benefits from co-funding by the Austrian Ministry of Finance, the Swiss State Secretariat for Economic Affairs, and the Austrian Development Agency.

The workshop’s success was underlined by positive feedback from participants, who noted both the relevance and the timeliness of the information and discussions. The active engagement of the insurance and pensions regulators throughout, together with participation of the National Bank of Macedonia, the Institute of Chartered Auditors of North Macedonia, the Council for Advancement and Oversight of Auditing, the Institute of Accountants and Chartered Accountants of North Macedonia contributed to the credibility and impact of the event.

EAASURE engagement with the North Macedonian Insurance Supervision Agency will continue, with a view to drafting a detailed action plan for the implementation and enforcement of IFRS 17 by 2027.